Property Shelling out - A Rewarding Way to Broaden Your Investment Profile

Real estate investing is definitely an excellent strategy to diversify your expense stock portfolio. But be mindful in selecting the appropriate house. Effective real estate brokers often make use of various strategies, which includes wholesaling and business-up strategies in addition they may buy REITs, similar to joint funds.

Property assets offer you wonderful taxes and earnings pros, assisting to minimize simple-word market imbalances whilst developing long-term riches growth.

Place

Real estate property committing may be one of probably the most profitable techniques for earning residual income. Leasing monthly payments from renters offer a constant method to obtain earnings that could protect residence expenditures or health supplement an investor's pre-existing cash flow source. Regrettably, even so, locating an ideal location for your leasing property can be challenging: its desirability affects rent costs and will raise profits dramatically.

Real-estate ventures provide traders several income tax positive aspects, such as depreciation and mortgage attention write offs. In addition, purchasing real estate property gives diversity in an investor's profile, which minimizes chance in a down marketplace. Investors that do not wish to come to be primary landlords may choose REITs that invest in real-estate belongings while paying dividends back out to traders.

Preferably, when picking the optimal area for your leasing residence, continue to keep its expansion prospective and closeness to work centres, purchasing, and amusement locations in mind. General public transportation systems with excellent providers will attract prospective citizens services close by can help bring in a more substantial pool area of tenants and improve cashflow.

Area can furthermore have a key result on a rental property's long term worth, specifically in central towns where new properties may be constrained, producing shortages in real estate provide and driving a vehicle up requirement for leasing properties for the reason that area. When investing in core metropolitan areas, make a note of their potential growth plans to steer clear of making errors with your investment choices.

If you're new to property investing, working with a highly skilled broker is very recommended. These specialists will assist you to get around what is wholesale real estate your local real estate market and recognize investments rich in profits in your investment. SmartVestor offers a no cost support which matches you up with as much as five investing pros in the area - you could see one through here as well!

Property assets require getting an best area that could create substantial lease earnings while appealing to a diverse set of residents. Mashvisor will help in aiding discover this sort of areas.

Home kind

Real-estate ventures vary from acquiring a person house to investing in huge industrial buildings, all of which provides its own set of risks and rewards. You should take your measure of involvement, danger patience, and earnings under consideration to choose the most suitable home kind on your own. Household alternatives could include single-family houses, multi-system components (like condominiums or condos), mobile phone home recreational areas or raw property purchases that keep undeveloped but may deliver increased earnings than established attributes.

Another choice for investing is buying home to rent. Although handling renters and paying taxation on rental cash flow needs more function, this form of expenditure delivers increased earnings than other types of making an investment and fewer volatility compared to conventional investments. Moreover, functioning expenditures could even be deducted on your tax statements!

Commercial components, which are non-non commercial property purchases, including lodges, industrial environments and places of work are a great method for traders to make stable income passes whilst understanding house values after a while. Moreover, these professional investments have a tendency to encounter a lot less monetary changes and provide investors satisfaction during monetary downturns.

Real-estate Purchase Trusts (REITs), public firms that own a number of residential and commercial attributes, will also help you invest indirectly. By buying reveals in REITs you may influence indirect investing although still entering the real estate community as they're a great way to start real estate property investing without every one of the headache that is included with offering person qualities immediately.

Along with residential and commercial real-estate ventures, you might also make natural terrain an effective tool school to purchase. Natural property typically depends on places with fantastic progress possible and will make for a lucrative give back if identified appropriately. In addition, undeveloped terrain may regularly be found for low prices. Prior to making your choice with an undeveloped plan of territory nonetheless, make sure to consider all relevant zoning laws as well as prospective fees associated with establishing it including operating electric, normal water, and sewer outlines towards the web site which could confirm costly when thinking about building houses on raw territory or making an investment in it in natural terrain - but before performing anything at all it will seem sensible for yourself well before diving directly in head first!

Funding

When purchasing real estate, there are numerous financing possibilities open to you. These could consist of typical lending options, individual cash financial loans and self-directed personal retirement life credit accounts (SDIRAs) focused on real estate property investment. Which credit strategy suits you is dependent upon your targets and level of experience in addition to if you can effectively deal with the home on your own daily managing wise. Ultimately, be sure you determine how a lot money is ready to be put towards such enterprise.

Real estate assets offer an best way to both create residual income and discover long term capital respect. There are numerous qualities it is possible to put money into - household, commercial and business. Many people invest in solitary houses to build leasing income although some pick getting and reselling residences as assets yet other individuals spend money on remodeled homes to be distributed upon finalization.

Real estate property traders in today's market experience growing competitors and higher interest levels, necessitating better understanding of the marketplace as a whole and having the capability to identify possible opportunities and dangers. To prosper in today's real estate property industry, it is actually essential that real estate brokers possess this sort of understanding.

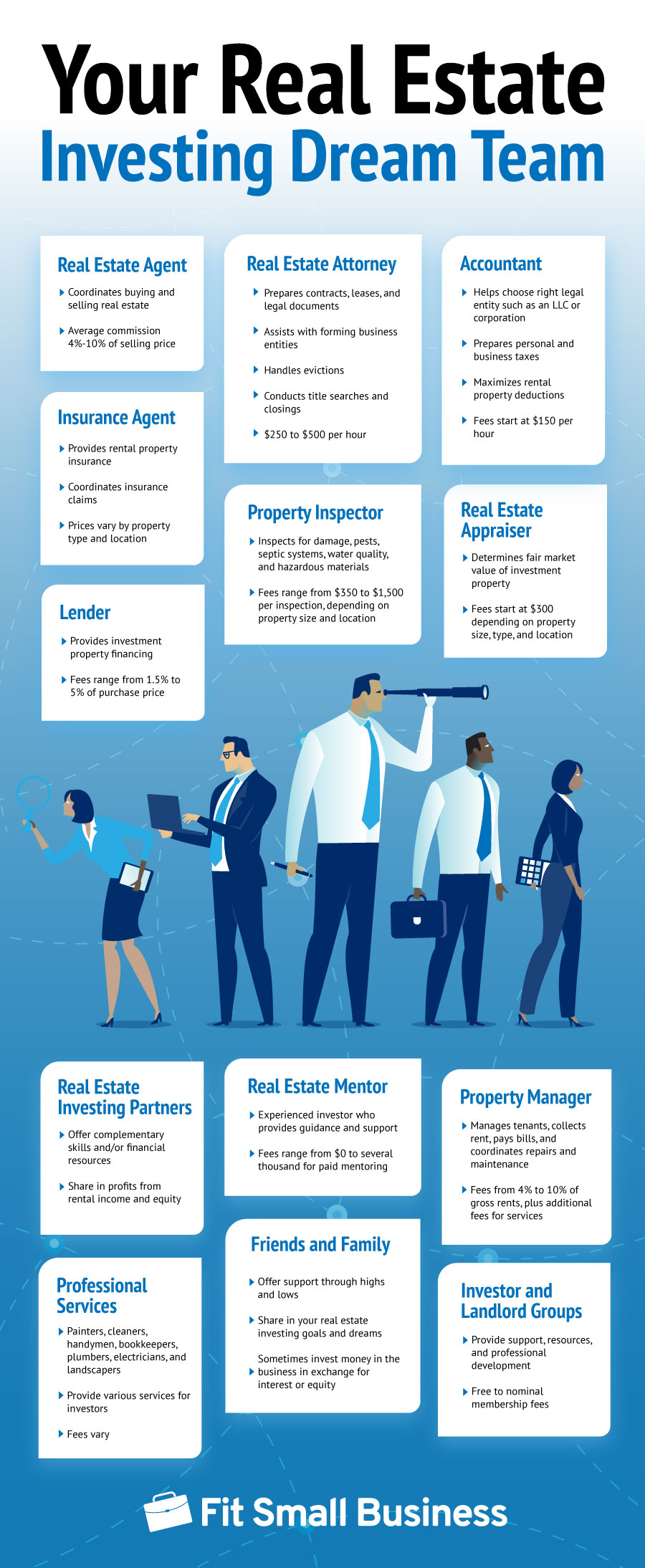

To be successful in actual real estate investing, you need to have the suitable mindset and group into position. Be ready for unexpected charges like maintenance charges or vacancies finally, usually have a backup prepare all set in case the marketplace turns against you.

Fund your premises employing bank financial loans or mortgage loans, but there are other choices like buying real estate expenditure trusts (REITs). REITs personal and manage real estate property attributes whilst paying out out dividends to their shareholders - offering another revenue stream.

A progressively well-liked way of loans real-estate is crowdfunding platforms, which link up developers and investors by supplying financial debt or collateral ventures in an arranged charge. When these purchases can be more dangerous and illiquid than more conventional tactics, they may offer diversity benefits within your stock portfolio.

Real estate property expense money provide another safe method for making an investment in properties this expenditure automobile pools together a number of investors' cash to buy a number of properties simultaneously, offering you entry to more components when earning passive income than committing immediately in one property.

Servicing

Real-estate expenditure is an attractive option for those looking for passive income. Real estate property provides several taxation and diversification pros nevertheless, traders ought to be conscious associated with a routine maintenance expenses which may affect all round earnings on investment moreover, lease attributes demand significant energy wholesaling real estate for beginners and time assets.

At the primary of each investment is keeping excellent circumstances inside a property. Doing this can boost its importance and attract renters in, reduce openings, minimize functioning expenses and make sure typical examinations take place included in a upkeep strategy.

Real estate property could be physically analyzed to help you brokers evaluate its good quality and determine its suitability being an expense opportunity. In addition, this inspection can identify any structural issues or some other issues that can minimize home ideals.

Real estate making an investment gives numerous unique pros, including income tax deductibility for mortgage fascination obligations, residence income taxes and improvements expenses. This may drastically reduced taxation obligations although simultaneously raising profits. Moreover, ventures typically provide higher cash moves - a stylish feature to the entrepreneur.

Real estate shelling out demands important upfront capital and will be inelastic as a result, it may take more time for returns on expense in the future through furthermore, finding renters during monetary downturns may confirm challenging.

Diversifying a real real estate portfolio is likewise vitally important, protecting buyers against marketplace variances and decreasing the danger of dropping dollars. Achieving this entails diversifying across numerous residence sorts, marketplaces and geographies - for example purchasing both commercial and residential qualities increases one's chances of building a income.,